DEVENS, Mass.--(BUSINESS WIRE)-- American Superconductor Corporation (NASDAQ: AMSC), a leading energy technologies company, today reported financial results for the third quarter of its fiscal year 2008 ended December 31, 2008.

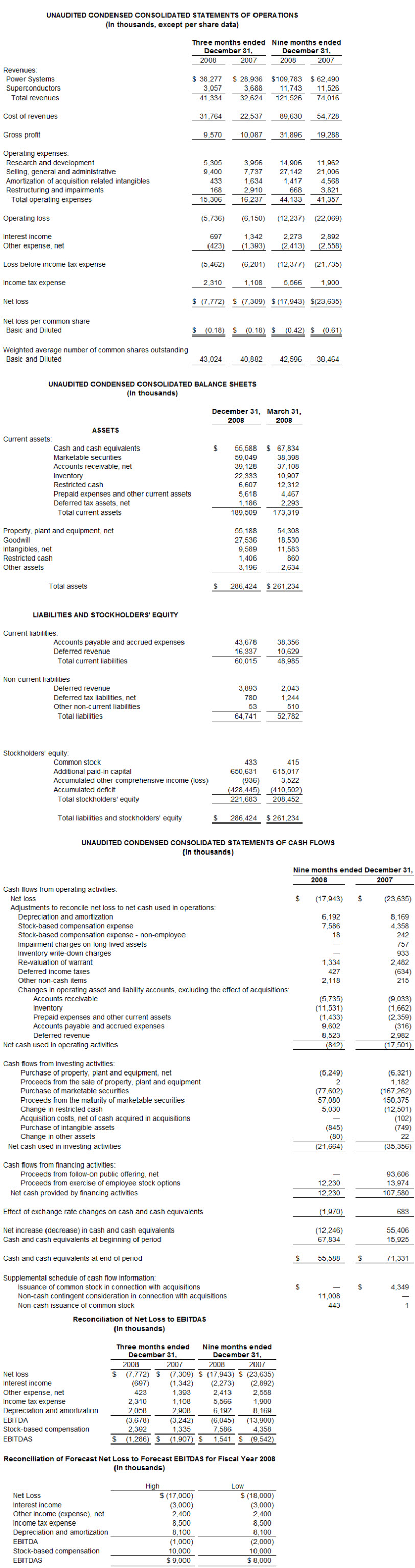

Revenues for the third quarter of fiscal 2008 were $41.3 million, a 27 percent increase over $32.6 million in revenues for the third quarter of fiscal 2007. Gross margin for the third quarter of fiscal 2008 was 23.2 percent, which compares with 30.9 percent for the third quarter of fiscal 2007. The company attributed the year-over-year reduction in gross margin primarily to higher than expected costs on certain long-term turnkey SVC and wind turbine design contracts, a charge for excess inventory related to PowerModule™ PM1000 subassemblies at one of AMSC’s subcontractors, and unfavorable foreign exchange effects.

The company’s net loss for the third quarter of fiscal 2008 was $7.8 million, or $0.18 per share. This compares with a net loss for the third quarter of fiscal 2007 of $7.3 million, or $0.18 per share. Net loss in each period includes non-cash, pre-tax charges for amortization of acquisition-related intangibles and stock compensation. The company’s results in the year-ago period also included mark-to-market adjustments on a stock warrant that was exercised in full in August 2008. Such items totaled $2.8 million for the third quarter of fiscal 2008, compared to $4.2 million for the third quarter of fiscal 2007.

Cash, cash equivalents, marketable securities and restricted cash at December 31, 2008 were $122.6 million. This compares with $128.9 million at September 30, 2008. The decrease was due to the company’s loss in the quarter, cash used for working capital and unfavorable foreign exchange effects.

The company reported backlog as of December 31, 2008 of approximately $602 million compared with $597 million as of September 30, 2008 and $168 million as of December 31, 2007.

Earnings before interest, taxes, other income and expense, depreciation, amortization and stock-based compensation (EBITDAS) were a negative $1.3 million for the third quarter of fiscal 2008. This compares with an EBITDAS loss of $1.9 million for the third quarter of fiscal 2007. Please refer to the financial schedules attached to this press release for reconciliation of EBITDAS to GAAP net loss.

“Our two core growth drivers – the Chinese wind power market and the U.S. power grid market – remained strong through our third fiscal quarter, a trend we expect to continue for the foreseeable future,” said Greg Yurek, AMSC’s founder and chief executive officer. “Wind continues to be our growth engine; however, more than $27 million of our $46 million in third-quarter bookings were for our D-VAR® Smart Grid solutions. With these new orders, we now have more than $175 million out of the total of $602 million in backlog that we expect to recognize as revenue in fiscal 2009. Our backlog position for both fiscal 2009 and the following two fiscal years and the strength of our core markets position us for strong growth in fiscal 2009 and beyond.”

Financial Forecast

“We expect to generate our first GAAP profit in the fourth quarter of fiscal 2008,” said David Henry, senior vice president and chief financial officer. “For full fiscal 2008, we have narrowed our revenue guidance from a range of $175 million to $185 million to a range of $178 million to $182 million. We are maintaining the guidance we provided on January 20 for a full fiscal 2008 net loss in a range of $17 million to $18 million, or $0.40 to $0.42 per share. We also are narrowing our EBITDAS forecast for fiscal 2008 from a range of $7 million to $10 million to a range of $8 million to $9 million.”

“For fiscal 2009, we continue to expect that we will generate a GAAP profit on more than $225 million in revenues. While the investments we intend to make in fiscal 2009 to help achieve our long-term growth plans may limit us to earnings of a few cents per share for full fiscal 2009, profitability is our top priority,“ Henry concluded.

Conference Call Reminder

In conjunction with this announcement, AMSC management will participate in a conference call with investors beginning at 10:00 a.m. ET today to discuss the company’s results and its business outlook. Those who wish to listen to the live conference call webcast should visit the “Investors” section of the company’s website at www.amsc.com/investors. The live call also can be accessed by dialing 913-312-1294 and using conference ID 1576540. A telephonic playback of the call will be available from 1:00 p.m. ET on February 3, 2009 through 1:00 p.m. ET on February 10, 2009. Please call 888-203-1112 and refer to conference ID 1576540 to access the playback.

About American Superconductor (NASDAQ: AMSC)

AMSC offers an array of proprietary technologies and solutions spanning the electric power infrastructure – from generation to delivery to end use. The company is a leader in alternative energy, providing proven, megawatt-scale wind turbine designs and electrical control systems. The company also offers a host of Smart Grid technologies for power grid operators that enhance the reliability, efficiency and capacity of the grid, and seamlessly integrate renewable energy sources into the power infrastructure. These include superconductor power cable systems, grid-level surge protectors and power electronics-based voltage stabilization systems. AMSC’s technologies are protected by a broad and deep intellectual property portfolio consisting of hundreds of patents and licenses worldwide. More information is available at www.amsc.com.

American Superconductor and design, Revolutionizing the Way the World Uses Electricity, AMSC, Powered by AMSC, D-VAR, dSVC, PowerModule, PQ-IVR, Secure Super Grids, Windtec and SuperGEAR are trademarks or registered trademarks of American Superconductor Corporation or its subsidiaries. All other brand names, product names or trademarks belong to their respective holders. The Windtec logo and design is a registered European Union Community Trademark.

Any statements in this release about future expectations, plans and prospects for the company, including our expectations regarding the future financial performance of the company and other statements containing the words "believes," "anticipates," "plans," "expects," "will" and similar expressions, constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. There are a number of important factors that could cause actual results to differ materially from those indicated by such forward-looking statements. Such factors include: uncertainties regarding the company's ability to obtain anticipated funding from corporate and government contracts, to successfully develop, manufacture and market commercial products, and to secure anticipated orders; the risk that the increasingly uncertain domestic and global economic conditions could result in customers delaying or reducing purchases of our products; the risk that a robust market may not develop for the company's products; the risk that strategic alliances and other contracts may be terminated; the risk that certain technologies utilized by the company will infringe intellectual property rights of others; and the competition encountered by the company. Reference is made to these and other factors discussed in the "Risk Factors" section of the company's most recent quarterly or annual report filed with the Securities and Exchange Commission. In addition, the forward-looking statements included in this press release represent the company's views as of the date of this release. While the company anticipates that subsequent events and developments may cause the company's views to change, the company specifically disclaims any obligation to update these forward-looking statements. These forward-looking statements should not be relied upon as representing the company's views as of any date subsequent to the date this press release is issued.

Note: EBITDAS is a non-GAAP financial measure defined by the company as net income before interest, taxes, other income and expense, depreciation and amortization, and stock-based compensation. The company believes EBITDAS is an important measurement for management and investors given the increasing effect that non-cash charges such as stock compensation, amortization related to acquisitions, taxes associated with AMSC Windtec and AMSC China, and depreciation of capital equipment will have on the company’s net income (loss). The company regards EBITDAS as a useful measure of operating performance and cash flow to complement operating income, net income and other GAAP financial performance measures. Additionally, management believes that EBITDAS will provide meaningful comparisons of past, present and future operating results. Generally, a non-GAAP financial measure is a numerical measure of a company's performance, financial position or cash flow that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. This measure, however, should be considered in addition to, and not as a substitute or superior to, operating income, cash flows, or other measures of financial performance prepared in accordance with GAAP. A reconciliation of EBITDAS to GAAP net loss is set forth in the table above.

Source: American Superconductor Corporation

American Superconductor Corporation (NASDAQ: AMSC)

Jason Fredette, 978-842-3177

Director of Investor & Media Relations

jfredette@amsc.com